Revolution in D&O insurance in Nevada (US insurance market) postponed

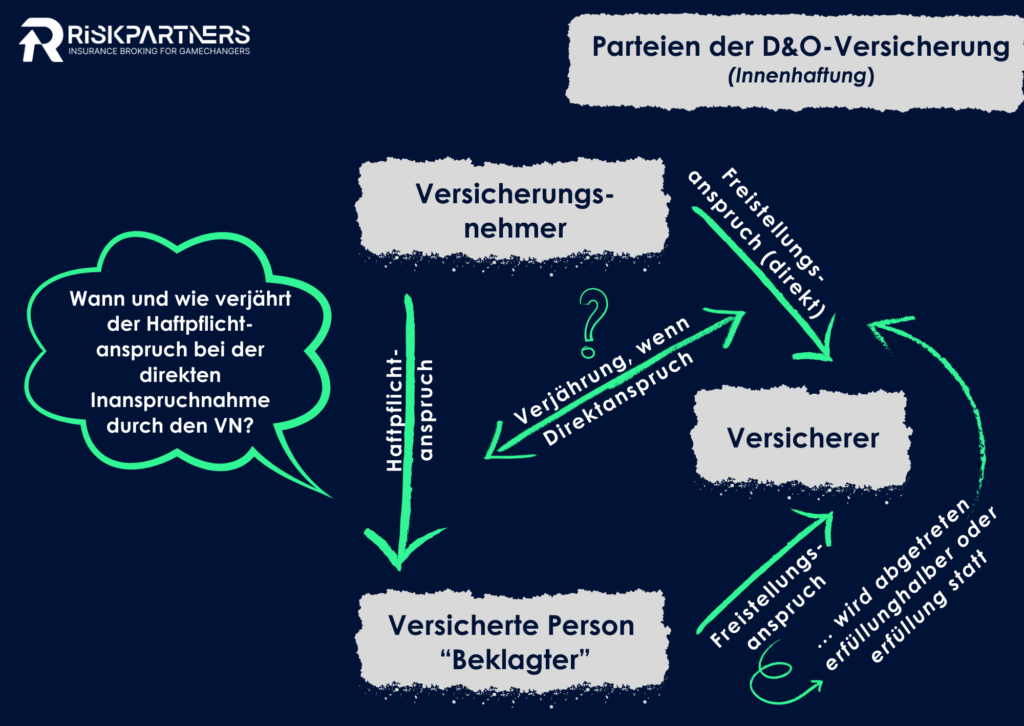

The revolution in D&O insurance in Nevada has been called off after all. In the US market, the state of Nevada passed an interesting law (Bill No. 398) in the summer with potentially significant implications for the D&O insurance market. The Governor of Nevada approved the bill on June 3, 2023, so the law came into force on October 1, 2023. We had classified this legislation (in the USA, insurance supervision is organized at state level) as too watchful for our clients, but this law