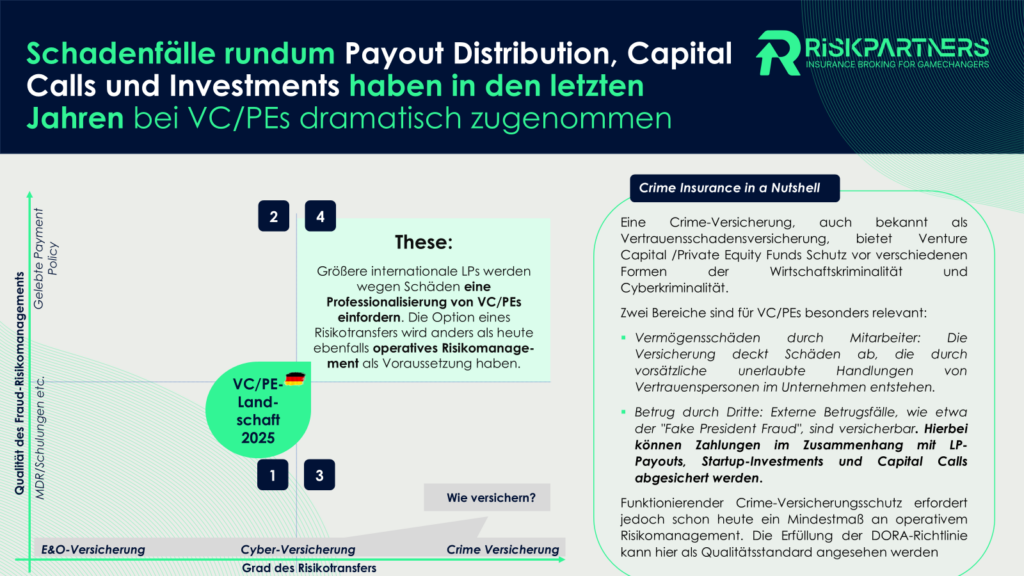

We provide information on liability risks for VC funds in the VC Magazine

In December, we were asked by VC-Magazin whether we could provide insights into liability and risk management issues relating to venture capital funds. With pleasure! Together with the team, Florian not only provided insights into current challenges, but also suggested practical solutions to effectively minimize and sensibly transfer the risks of a VC fund. In the VC Magazine article, you will therefore find: added value of customized insurance concepts for VC funds (focus: D&O/E&O insurance #Moonshot Protect), key measures for risk prevention (learning curve from our claims world), indemnifying contractual provisions as a preventive measure, and