Risk Partners Life Sciences Roundtable 2025, thank you very much!

Risk Partners Life Sciences Roundtable 2025, thank you very much!

In our series on D&O insurance and the requirements of specific industries - see Part 1: "Everything you need to know about D&O insurance for growth companies" and Part 2: "D&O insurance for GPs of venture capital and private equity funds" - we would now like to turn our attention to the special requirements of "(interim) boards" in private equity-backed platform companies.

In particular, we address the key aspects that need to be considered when setting up a functioning D&O insurance program - especially for the rapidly growing group of these companies due to the buy-and-build approach.

As the successful implementation of buy-and-build strategies requires experience, we regularly work with the same interim managers who are familiar with the specific challenges of the insurance process. Equally important is the experience of the insurance broker, especially in dealing with the typical "insurer pain points".

As a specialist insurance broker for private equity companies, one of our core tasks is to develop and implement D&O insurance programs that are sustainable in the long term. This often involves the challenge of insuring an "emerging" conglomerate; an entity that is not yet fully reflected in the platform company's financials in the status quo and cannot be perfectly planned in a business case due to the option structure. In negotiations with insurers, we are helped by our many years of cooperation and the trust we have gained in the risk profile we have outlined. The same applies to the special features presented below for buy-and-build cases of our private equity clients.

98% of the D&O insurance policies available in Europe are so-called claims-made policies. In this case, it is not the time of the breach of duty that is decisive for the insurance cover, but the time of the claim against the insured person. In order to remedy the disadvantages of the claims-made principle, almost all D&O insurance policies have unlimited retroactive cover for past breaches of duty that were unknown when the policy was taken out, as well as a subsequent notification period for claims asserted later after the policy has ended, provided these arose during the retroactive cover or policy term.

Problem of delimitation when changing insurer:

A frequent change of insurer can nevertheless lead to considerable delimitation problems. Although most terms and conditions contain a delimitation clause (e.g. "more recent cover takes precedence"), disputes regularly arise between insurers about the actual start of the breach of duty, which can regularly extend over several years, e.g. in the case of organizational negligence. These conflicts often work to the disadvantage of the insured person.

The importance of a long-term partner:

This results in a central task for the insurance broker: the careful selection of a long-term partner as the primary insurer for the buy-and-build case. A stable insurer should not only be able to support internationalization ("(un)coordinated international D&O insurance program"), if relevant, but also be prepared for a possible exit on the capital market (e.g. POSI insurance), so that a later change of insurer can be avoided and thus the important continuity can be ensured.

Special features for subsidiaries:

For buy-and-build cases, in addition to the unlimited retroactive insurance of the policyholder, the provisions for additional subsidiaries are also decisive. In such cases, it may make sense to extend the limited retroactive insurance for a single premium, e.g. to provide protection for breaches of duty prior to the transaction if the portfolio company's D&O insurance was previously insufficient. This extension can be of considerable value for the balance sheet and thus the success of the transaction in the event of subsequent claims. However, it is important to keep an eye on the deadlines for these options, as they are not available indefinitely.

Integration with M&A insurances:

We are happy to manage the entire process in combination with M&A insurances that primarily cover contractual risks from the purchase agreement (W&I insurance) or special balance sheet risks (tax, legal). Together with our cooperation partner HWF Partners, we ensure that the right protection is in place from day 1 of the transaction.

We let our work and our clients speak for us.

"The high professional quality and customer orientation in the advice and cooperation with Mr. Eckstein and his team ensure that we always feel that we are in good hands with the special requirements as a globally active SDAX company, for example in complex questions of capital market liability. As a listed investment company, Risk Partners' structured and professional support is decisive for us when choosing our broker."

"In a joint project for the public placement of a EUR 500 million bond, Florian impressed us with his well thought-out structuring and processing of capital market liability in the concepts for D&O and prospectus liability insurance. With his competent advice, all stakeholders, from the management board to the supervisory board and the accompanying banks, felt well taken care of."

"As a venture capital company, we were very satisfied with the advice provided by Björn and his team. We were impressed by their in-depth understanding of the industry and their innovative strength, which is why we are happy to recommend Risk Partners."

"It was a pleasure working with Florian on our cross-border De-SPAC transaction. Especially having two jurisdictions with the SPAC being Dutch registered and the target being a German headquarted company brought up several liability items that Florian was able to tackle down in a tailor-made D&O insurance solution. This was key for both managements to proceed on the transaction and the sucessfull closing of the project."

Insurer requirements and reporting obligations for buy-and-build cases

In principle, an insurer wants to have the risks it has assumed checked. Exceptions to this are special clauses such as the third-party mandate clause or regulations on additional subsidiaries that do not trigger an immediate reporting obligation. Depending on the planned procedure, timetable and attractiveness (profitability, target sectors, experience of the PE) of the buy-and-build case from the perspective of the D&O insurer, various implementations are conceivable:

"Standard" reporting obligation:

Companies that are added are automatically insured as long as the balance sheet total does not increase by a certain percentage (usually 30%). However, this clause often leads to numerous reports and questions of definition, as the balance sheet total is not limited to certain annual financial statements. In order to avoid risks, almost everything is often reported with such bad clauses.

More flexible and defined reporting obligations:

These concepts take into account both changes in turnover and changes in the balance sheet total in the interests of the policyholder and provide for periods of e.g. 24 months for the underlying annual financial statements in order to create better comparability. Properly designed, the reporting obligation can be significantly reduced.

"Organization chart clause":

If there is a high level of trust with the insurer, a 6- or 12-month preventive insurance can be agreed. The final insurance cover requires the policyholder to submit an up-to-date organizational chart and current financials. This reduces the effort involved to once or twice a year.

Broker management and automation:

By using LegalTech solutions such as Fides Technology, workflows can be implemented that automatically inform brokers about newly on-boarded subsidiaries. These workflows supplement standard processes such as Google Alerts at our company and make it possible to ensure proper insurance cover even if the client fails to notify us.

Recommendation:

If you have not yet been advised on this, your terms and conditions will most likely include the "standard" reporting obligation and a short precautionary insurance policy. In this case, check carefully whether the desired insurance cover is actually guaranteed across all companies. In the event of a claim, insurers are often well prepared to correctly cite an undeclared company as a reason for exclusion.

Over time, it may make sense to adjust the conditions. Especially if the platform company's turnover and balance sheet total grow to a level where the thresholds go from critical to comfortable. A timely changeover can thus ensure stable insurance cover in the long term.

Differentiation of D&O programs for private equity and portfolio companies

It is important to sensibly coordinate the two D&O programs - that of the private equity company and that of the portfolio companies - in order to avoid accumulation risks. A limitation of one's own risk, which insurers like to secure for themselves in the small print. A different selection of insurers and the right insurance conditions can offer considerable added value in this context.

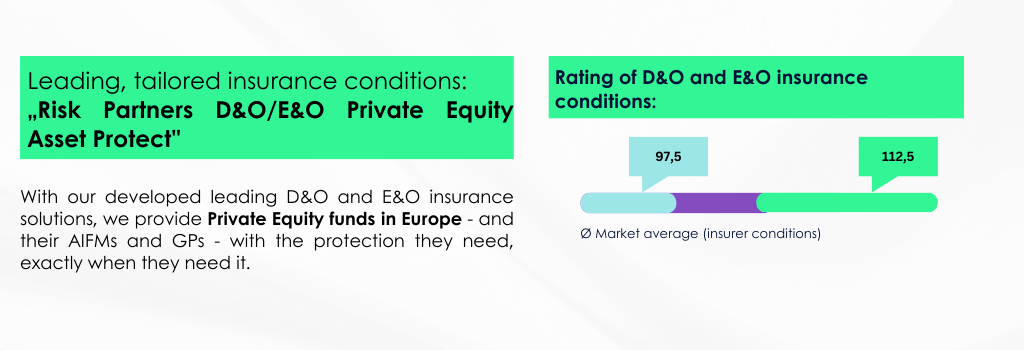

In our market-leading D&O/E&O insurance conditions(Risk Partners D&O/E&O Private Equity Asset Protect 2025) for private equity AIFM, seconded persons of the private equity company automatically enjoy insurance cover via the third-party mandate clause (also known as the ODL clause) - a notification (usually nowendig!) is not required for this. In addition, operational activities, such as those of an interim CFO, are also insured under the D&O/E&O in our concept.

However, it can also be problematic for these seconded persons if they are covered by the terms and conditions of both the portfolio company and the AIFM. Without clear coordination, this can lead to limited insurance cover - either due to an accumulation clause or due to delimitation disputes between two insurers.

To avoid such scenarios, a holistic strategy from your insurance broker is essential. This should take into account the typical functions in buy-and-build cases and ensure that there are no surprises in the event of a claim. In order to avoid interface problems between advisors, we offer this from a single source and can also offer you so-called portfolio D&Os across your entire portfolio in order to leverage economic synergies while at the same time taking into account the individual insurance requirements of the people involved in the portfolio companies.

Do you have any questions about how to protect yourself or your portfolio companies against directors' and officers' liability risks in a way that is cost-effective and minimizes your workload? Let's talk at your preferred time:

Creativity and

innovations

Experienced D&O experts

Probably the most important insurance for a clinical trial worldwide. Our experts provide a brief introduction.

If patents/IP is the value of your company, you can find out everything you need to know about relevant insurance policies here

Alongside D&O insurance, this is probably the most important insurance for a European IPO. Our experts provide a brief introduction.

Another important insurance for volunteers in clinical trials. Our experts briefly introduce these.

Request our guides now