Risk Partners Life Sciences Roundtable 2025, thank you very much!

Risk Partners Life Sciences Roundtable 2025, thank you very much!

Keyman insurance transfers the financial consequences of the loss of a key person to the insurer. In the event of a claim, a one-off lump sum payment is typically made to the company in the event of an insured event, such as the diagnosis of an insured illness or death. Due to our frequent advice to gamechangers in the life sciences, venture / private capital and growth company sectors, we often recognize the high value of individuals and the associated need for advice on Keyman insurance. This article is intended to provide comprehensive information about key man insurance. If you have any questions, please do not hesitate to contact us as your Risk Partners.

Key man insurance, also known as key person or key person insurance, is a special type of life or accident insurance that a company takes out for an essential person in the company. Such individuals may be directors, officers or other employees whose skills, knowledge and experience are essential to the success and stability of the business. These are often the founders of a start-up, who make up the value of the company, especially at the beginning. However, this topic is also often particularly relevant for small and medium-sized companies, as the managing directors and owners are often heavily involved in operational activities.

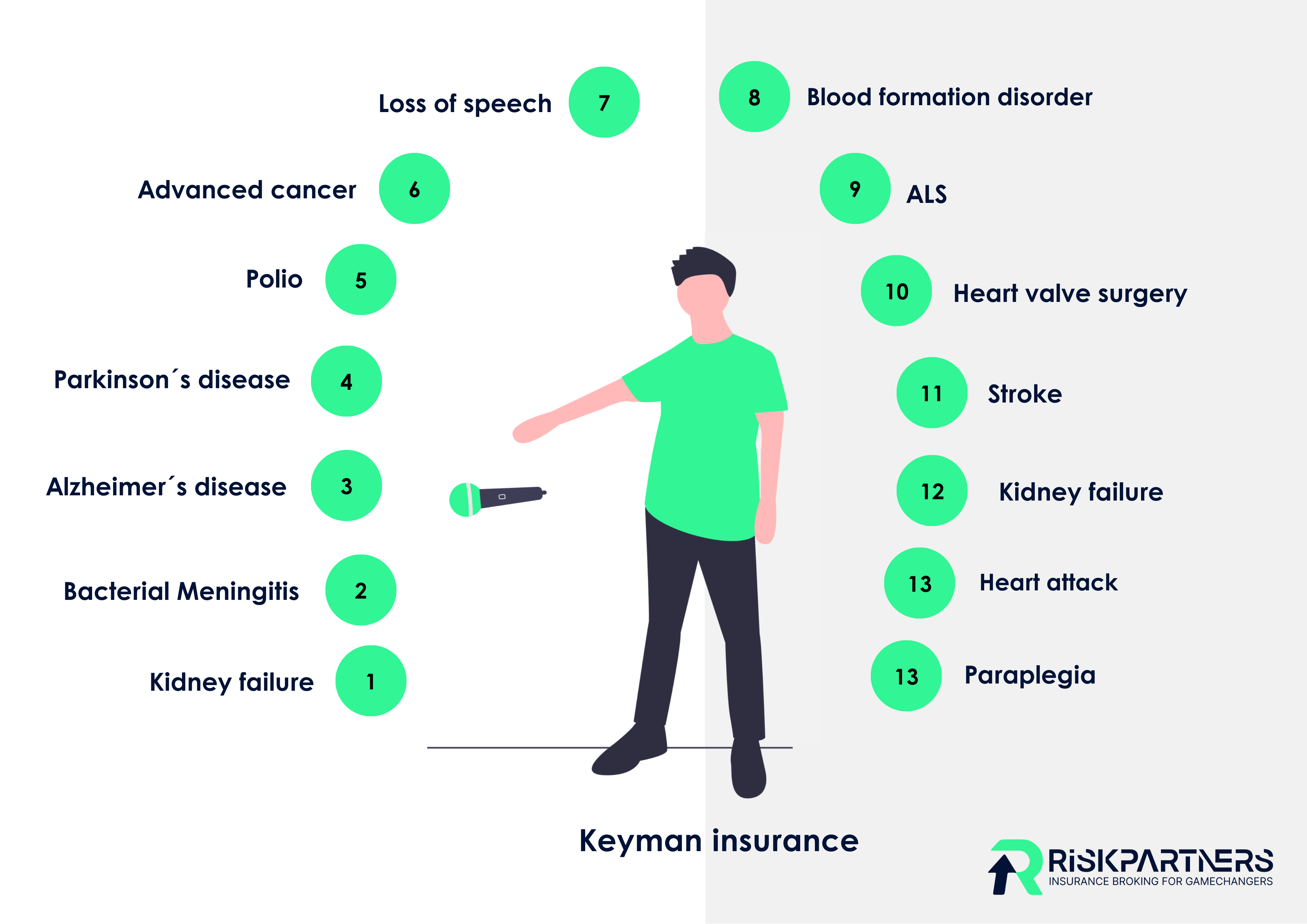

The benefits promised by key man insurance are aimed at mitigating or compensating for financial losses that could arise due to the unexpected loss of this key person, whether through death or serious illness (see examples of illnesses in the adjacent diagram and the list below). The insurance benefits can be used, for example, to finance the search for and training of a replacement employee, to compensate for lost profits or to secure loan liabilities for which the key person has guaranteed.

Keyman insurance is therefore a central risk management tool for companies to minimize financial risks or create liquidity in times of crisis that can be caused by the loss of a key person. Such insurance also demonstrates to investors, lenders and partners that the company proactively manages risks and is prepared for unforeseen events, which boosts confidence and can improve creditworthiness or increase the desire to invest.

The following is a list of illnesses that can be covered by Keyman insurance, arranged according to the general probability of occurrence for an adult:

The following is a list of illnesses that can be covered by Keyman insurance, arranged according to the general probability of occurrence for an adult:

The tax treatment of Keyman insurance differs significantly between corporations and partnerships, which has relevant implications for both the premium payments and the insured event.

The advantage for corporations (e.g. GmbH, AG, SE) is that the contributions to a Keyman policy can be deducted as operating expenses. This leads to an immediate reduction in taxable profit. If the insured event occurs and the insurance benefit flows into the company account, this must be taxed as business income in the year of receipt. However, this benefit usually results in business-related expenses, which means that there is normally no increase in profit. Keyman insurance for corporations can therefore offer both tax advantages in terms of premium payments and effective protection without a significant tax burden in the event of a claim.

The situation is different for partnerships (e.g. KG). Here, the contributions for a Keyman policy cannot be booked as business expenses. As a result, there is no direct tax relief from the premium payments. In return, however, the insurance benefit in the event of a claim is not classified as business income and is therefore not subject to taxation. This regulation reflects the tax classification of partnerships, where the tax consequences are attributed directly to the partners.

In order to conduct a market survey on key man insurance, it is important to collect specific information about the key persons and to provide this to the insurers in a structured manner. Below you will find an overview of the information that is regularly required:

Our aim as insurance brokers is to make this process as efficient and uncomplicated as possible for you. We understand that time and resources are valuable and therefore strive to minimize the effort for you. In the following, we would like to introduce you to the process of comparing Keyman insurance and our consulting approach.

We see two cases here:

In consultations, we also take individual factors into account when determining the sum insured, including in extracts:

Depending on the evaluation of the factors, this individual procedure leads to a more accurate result for the company than the above-mentioned guideline value.

Our Managing Director Florian was a guest on the Recruiting DNA podcast by the life science specialists from Pates and gives valuable tips on the topic of "manager liability".

"We see the demand for key man insurance for the founding team, particularly in term sheets from US investors. Surprisingly, not only for early-stage seed investments, but also for a Series A/B, because the sums involved are larger."

Florian Eckstein - Managing Partner Risk Partners GmbH

Keyman insurance can be terminated under certain circumstances.

On the one hand, Keyman insurance can be terminated in the normal way at the end of the insurance period (after the expiry of a minimum contract term, if applicable). This gives companies the flexibility to regularly review the insurance policy and, if necessary, adjust or renew it to meet the company's current risks and needs.

Secondly, there is the option of extraordinary termination in the event of a so-called risk event. Such a case occurs when the insured key employee leaves the company. As the company is both the premium payer and the beneficiary of the policy, the original purpose of the insurance no longer applies when the key employee leaves.

The biotech start-up GenInnovate GmbH, which is working on a breakthrough in cancer therapy, suffers a setback when its leading researcher unexpectedly suffers a long-term stroke. His absence delays the research and jeopardizes important partnerships with a pharmaceutical company as well as the upcoming financing round. GenInnovate is able to cushion the financial losses with the Keyman insurance policy taken out for key personnel such as Dr. Bergmann. The insurance benefit makes it possible to bring in external experts and continue the research, saving the project and securing the future of the start-up.

We will not only assist you with the important decision on the cost side of key person insurance, but will also advise you in detail on the significant differences in the benefits offered by various providers. Our aim is to provide you with transparent advice to help you make a well-considered choice. Below you will find examples of some of the criteria we take into account when reviewing the policy conditions for you:Early payouts for specific events

If your Keyman insurance policy is taken out in connection with a VC fund, we will also review the contractual clauses for you with regard to any content requirements (due diligence / death benefit, specific illnesses covered, etc.).

Provider | Dread Disease (insured illnesses) | Dread Disease (benefit) | Death benefit | Costs |

|---|---|---|---|---|

Insurer A | 45 serious illnesses, 21 minor illnesses (lower benefit) | 200.000 € | 200.000 € | 147,37 € |

Insurer B | 48 (serious) illnesses | 200.000 € | 5.000 € | 147,67 € |

Insurer C | 55 (serious/mild) illnesses | 200.000 € | 2.000 € | 157,65 € |

Keyman insurance is an essential pillar of a company's risk management, which plays an important role in securing the financial stability and liquidity of smaller companies in particular, especially start-ups and scale-ups. This is one of the reasons why venture capital funds from the USA are increasingly demanding it. Properly implemented, it offers indispensable protection to cushion the financial losses that can result from the loss of a key person. However, comprehensive risk provisioning requires more than just financial compensation. Organizational measures are just as crucial to ensure the continuity of the company in crisis situations.

A well thought-out emergency plan ideally complements the keyman insurance by regulating how to react to the loss of a key person at an organizational level. This includes the involvement of relevant persons such as lawyers, the coordination of headhunting, access to important passwords and admin access, as well as regulations on precautionary and corporate powers of attorney. In addition, the planning of the company management in terms of what is unusual is of great importance. The prior recording of his ideas and wishes provides valuable orientation for the continuation of the company.

An emergency plan that takes all these aspects into account contributes significantly to the resilience of the company and ensures its continued existence in critical times. As your risk partners, we not only advise you on how to take these organizational precautions, but also offer you access to optimal insurance solutions as an independent insurance broker. Our expertise and support ensure that you are not only financially but also organizationally well positioned to successfully master the challenges that the loss of a key person can bring.

Probably the most important insurance for a clinical trial worldwide. Our experts provide a brief introduction.

Unlimited liability and when D&O insurance should be purchased. Our experts briefly introduce them.

If patents / IP is the value of your company, you can find out everything about relevant insurances here

Another important insurance for volunteers in clinical trials. Our experts briefly introduce these.