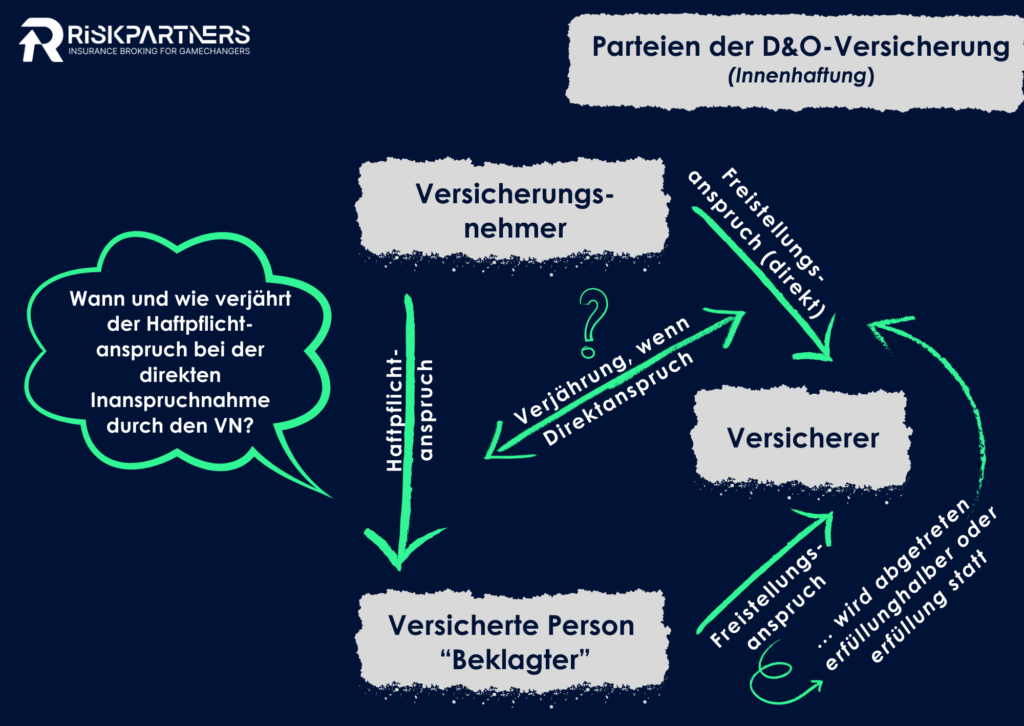

OLG Schleswig – Statute of Limitations for Liability Claims in the Case of Direct Claims in D&O Insurance

OLG Schleswig: Statute of limitations for liability claims in the case of direct claims in D&O insurance. There is a new, exciting verdict from the world of D&O insurance. Recently, we reported on the decision of the Higher Regional Court of Cologne in the context of the direct lawsuit. Now the Higher Regional Court of Schleswig has also made a groundbreaking decision. What was it about? The focus was on the question of the statute of limitations. However, it must be taken into account that the question of the statute of limitations in the event of a D&O claim is not trivial. On the one hand, there is the original claim for damages (statutory D&O liability