13th Hamburg Financial Lines Forum

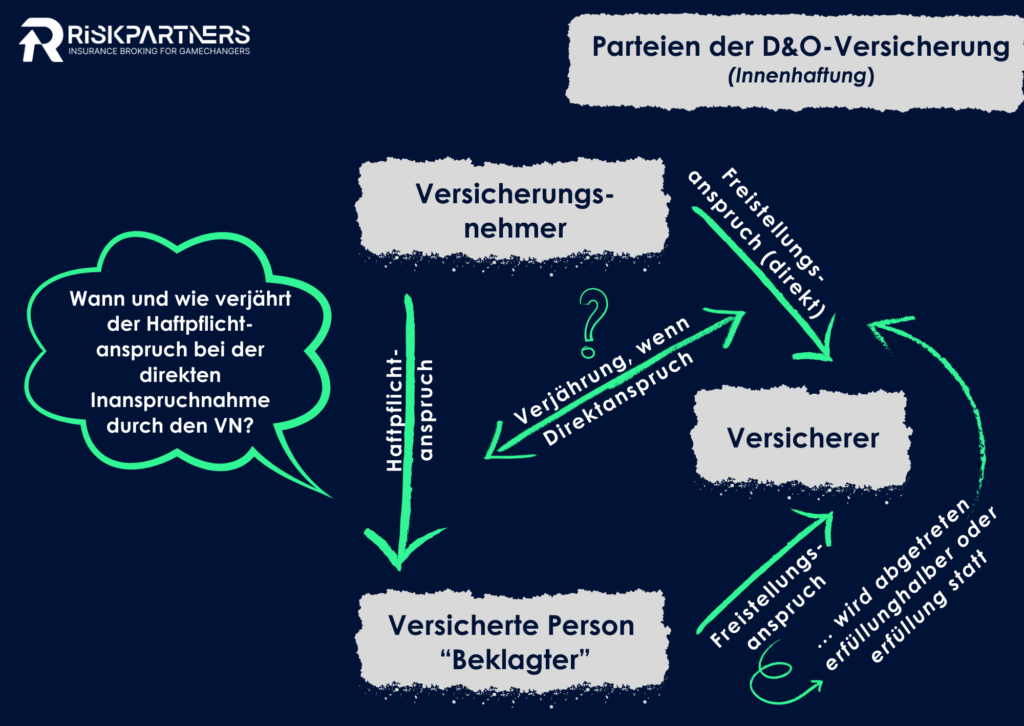

Risk Partners at the Financial Lines Forum 13th Hamburg Financial Lines Forum. On October 12 and 13, 2023, the 13th Hamburg Financial Lines Forum took place with the participation of Risk Partners, a traditional event that once again served as a platform for the exchange of current trends. The program began with an overview of current developments and the handling of claims in financial lines, presented by Gabriele Schreiber-Sahin and Michael Hendricks. Dr. Oliver Sieg then shed light on directors' and officers' liability and the