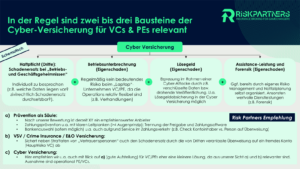

How managers protect themselves from personal liability in the event of cyber incidents - #29Minutes by Control Risk & Risk Partners

How directors and officers protect themselves from personal liability in the event of cyber incidents - #29Minutes by Control Risk & Risk Partners Looking at our claims experience in the area of directors' and officers' liability in recent years, internal claims alleging inadequate cyber risk management and emergency management in the event of a cyber attack are unfortunately on the rise. In addition to special risk transfer solutions (cyber and CDI insurance), there are also very practical tips on how to react correctly if the worst comes to the worst. Following an exchange at a risk management conference in Q1 of this year