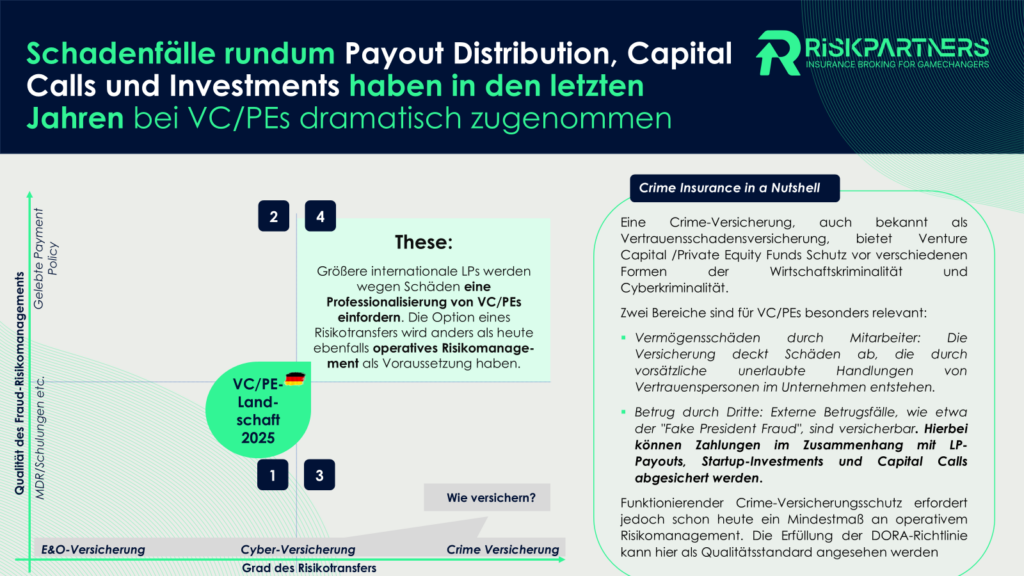

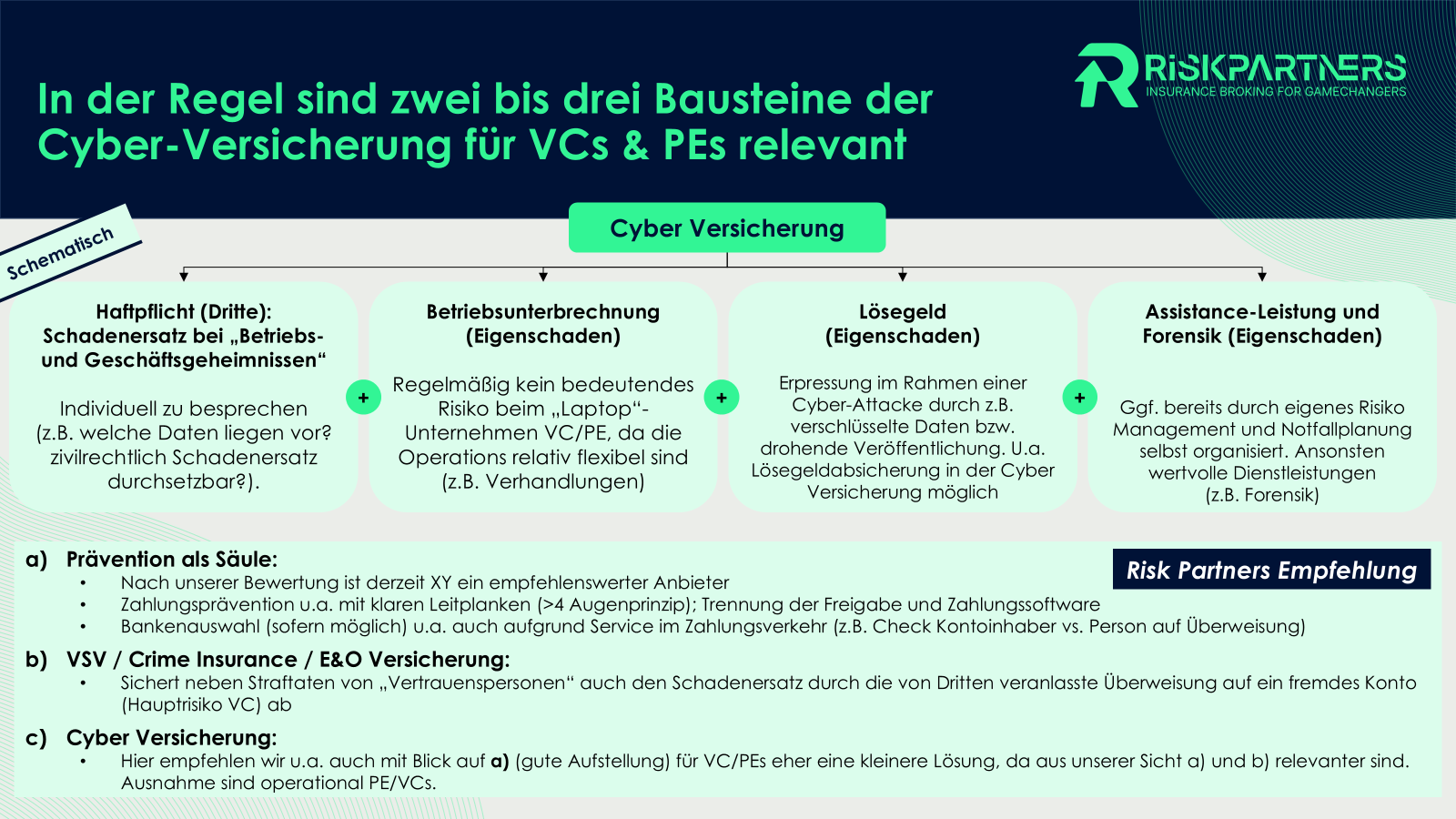

Cyber insurance Venture capital and private equity

Why cyber insurance does not transfer the core risk of VC & PE funds and why we have invested in Risk Partners cyber master agreements. Why cyber risks are relevant for venture capital and private equity funds With the increasing growth of the cyber crime industry (see Federal Office for the Protection of the Constitution), venture capital (VC) and private equity (PE) funds and their fund managers are also increasingly exposed to cyber risks. For years, this has been reflected in the claims we have been able to support, in which fund managers have been exposed to cyber risks year after year.