Risk Partners Life Sciences Roundtable 2025, thank you very much!

Risk Partners Life Sciences Roundtable 2025, thank you very much!

In our series on D&O insurance and the requirements of specific sectors - see Part 1 "Everything you need to know about D&O insurance for growth companies" and Part 3 "D&O insurance for the platform in the buy-and-build case" - we would now like to summarize the most important information on D&O insurance for the "governing bodies" (GPs) of PE/VCs. In addition to private equity and venture capital funds/VCs, this information applies analogously to closed-end real estate funds, closed-end infrastructure funds, closed-end private debt funds, closed-end energy and environmental funds, hedge funds, REITs, funds of funds, impact and sustainability funds, etc., although the E&O insurance section in particular should be adapted. Moonshot Protect (VC), Real Estate Protect (RE AIFM) or Asset Protect (PE) are examples from our company of such tailor-made solutions.

The role of a general partner (GP) in venture capital (VC) and private equity (PE) funds is associated with considerable responsibilities and risks. In addition to the responsibility for capital allocation, unlimited personal liability is the main focus. The main bases of liability in Germany, Luxembourg and the Netherlands are:

Germany: According to § 43 GmbHG, managing directors are liable without limitation with their private assets if they breach their duty of care. Liability includes internal and external liability. The fact that this also applies to GmbH & Co. KG structures has been confirmed by recent case law:

In its judgment of September 17, 2021(case no. 11 U 71/20), the Higher Regional Court of Hamburg ruled that the managing director of a managing limited partner GmbH is liable to the GmbH & Co. KG by analogy with Section 43 GmbHG. This puts him on an equal footing with the managing director of a general partner GmbH in terms of liability law.

On March 14, 2023(case no. II ZR 162/21), the Federal Court of Justice dealt for the first time with the question of whether the managing director of a general partner GmbH is also liable for the limited partnership pursuant to Section 43 (2) GmbHG if the management is not the central or exclusive task of the GmbH. The BGH came to the conclusion that liability also exists in such constellations, whereby the responsibility of the managing director is extended to the limited partnership, even if the management of the KG is only a secondary task of the GmbH.

Netherlands: According to Article 2:9 of the Dutch Burgerlijk Wetboek (BW), directors are liable for gross breaches of duty within the scope of their function. This includes, in particular, breaches of statutory or contractual requirements.

Luxembourg: According to Article 59 of the Law of August 10, 1915 on commercial companies, directors are personally liable for breaches of duty that lead to damages. Here too, unlimited liability applies both internally and externally.

In this context, D&O insurance is becoming an indispensable protection instrument. This article highlights the importance of D&O insurance for GPs and the link to Errors & Omissions (E&O) insurance. For details on E&O insurance, please refer to our article E&O insurance - venture capital and private equity funds and for details on D&O insurance for VC-financed growth companies, please refer to our article "D&O insurance for growth companies".

General partners bear comprehensive liability, both internally towards their own AIFM and externally towards third parties such as limited partners (LPs) or regulatory authorities. Typical liability risks include:

Incorrect investment decisions or inadequate due diligence ("dissatisfied investors").

Regulatory and compliance violations, e.g. in the area of GDPR, DORA, SFDR or AML/KYC requirements.

Claims arising from breaches of investment guidelines.

Disputes/claims with authorities (CSSF/BaFin)

Claims of insolvency administrators in portfolio companies. Note: in this context, the liability of the advisory board members (e.g. by arguing into the de facto liability of the managing director)

The five principles of directors' and officers' liability for GPs:

Unlimited liability: General Partners have unlimited liability with their private assets.

Low hurdle: Liability begins with slight negligence at the GP.

Joint and several liability: GPs are not only liable for their own negligence, but also for breaches of duty by other board members. Even a supposedly clear division of responsibilities does not offer complete security.

Reversal of the burden of proof: In the internal relationship, the defendant BP must prove that it did not commit a breach of duty and that the necessary care was exercised. This is often made more complicated by difficult access to exonerating documents in the event of a dispute. Sidekick: This is one of the reasons why we sought cooperation with Fides and developed a holistic approach.

Obligations of supervisory bodies: Supervisory bodies and insolvency administrators are legally obliged to pursue the interests of shareholders and creditors. This may necessitate legal action against GPs in order to avoid damages in the internal relationship.

In practice, 3 and 4 are highly relevant points for making a claim unpleasant for a BP.

In practice, D&O insurance is often combined with E&O insurance to ensure comprehensive protection. E&O insurance focuses on financial loss claims arising from the operational activities of the KVG or the fund. Examples include breaches of investment guidelines or errors in the qualification of LPs.

This close integration between D&O and E&O insurance reduces demarcation problems and avoids disputes with the insurer about the scope of cover when things get serious.

Situation: When investing in a deep-tech company, a GP of a VC fund did not sufficiently check whether the company infringed existing patent rights. After the investment, it turns out that the start-up has to accept considerable legal costs and production stoppages due to a lawsuit filed by a competitor.

Problem: The LPs initially accuse the KVG of having breached its due diligence obligations and demand compensation for the lost investment.

E&O insurance cover: E&O insurance covers the costs of defending the claim and, if necessary, settling justified claims. No E&O insurance available?

Problem: The LPs must change the claim to directors' and officers' liability (organizational negligence) in order to obtain the private assets of the BP(s).

D&O insurance cover: D&O insurance covers the defense costs of the lawsuit and, if necessary, the settlement of justified claims. However, a settlement may be necessary (see Winterkorn/Dieselgate) because the legal situation is so unclear. The LPs may also enforce the separation from the GP in the process.

Situation: A cyber-attack leads to the compromise of a Capital Call's account details. An LP's funds are transferred to a fraudulent account before the fraud is discovered.

Problem: The LPs accuse the GPs of not having invested sufficiently in the IT security of the fund and demand compensation for the lost amounts.

D&O insurance cover: The insurance covers the costs for the legal defense of the GPs as well as the reimbursement of justified claims of the LPs.

Situation: A GP is held liable in the context of the insolvency of a portfolio company. The insolvency administrators claim that the GP neglected his supervisory duties as a member of the advisory board and thus contributed to the insolvency.

Problem: The GP is confronted with considerable personal claims for damages, which not only jeopardize his reputation but also his assets.

Our Managing Director Florian was a guest on the podcast of the life science specialists from Pates and gives valuable tips on the topic of "manager liability".

The following factors influence the premium amount:

Fund size and volume: Larger funds have higher risk profiles and require higher sums insured. This generally leads to higher premiums.

Sum insured: On average, the premium for the first million euro sum insured is around 7,000 to 8,500 euros. Additional capacity can be added at a lower cost.

Investment focus: Funds that invest in high-risk sectors such as cryptocurrencies or biotechnology can expect to pay a premium. Geographic focuses, such as investments in the USA, can also increase costs.

Risk management and governance: Funds with robust internal processes, such as effective AML and KYC checks, can receive premium discounts. Insurers take the quality of internal risk management into account when setting premiums.

Combined policies: Costs can often be reduced by combining D&O and E&O insurance. However, care must be taken to ensure that sufficient separate limits or other individual adjustments are guaranteed.

Benchmark data: According to Risk Partners' benchmark database, annual net premiums for a pure D&O insurance policy vary from around EUR 3,000 to six-figure premiums for very large investment companies.

The assumption of activities in portfolio companies can also give rise to private liability as a governing body: whether as a controlling body (advisory board or supervisory board) in this very function, as a de facto managing director (insolvency administrators often argue that a person should be forced into this role in order to gain access to private assets) or directly as a managing director.

In these cases, if the conditions are good, the GP is covered both by the D&O cover of the portfolio company and by the policy of the PE/VC fund.

Important: Not every third-party mandate clause in the D&O terms and conditions of PE/VC companies covers all of the constellations described. In particular, the critical de facto managing director liability is not covered, as the insured functions of seconded employees in non-insured companies (e.g. portfolio companies) do not include "de facto managing director liability". In rare cases, there are also D&O conditions on the market that do not include certain roles in the group of insured persons. Therefore, make sure that the group of insured persons expressly includes de facto directors' liability and that the third-party mandate clause also covers this constellation and does not work with a limited group of insured persons. The experts from YPOG address the increased relevance of these liability cases driven by insolvency administrators in the Digital Kompakt podcast: 5 myths about liability in your own company

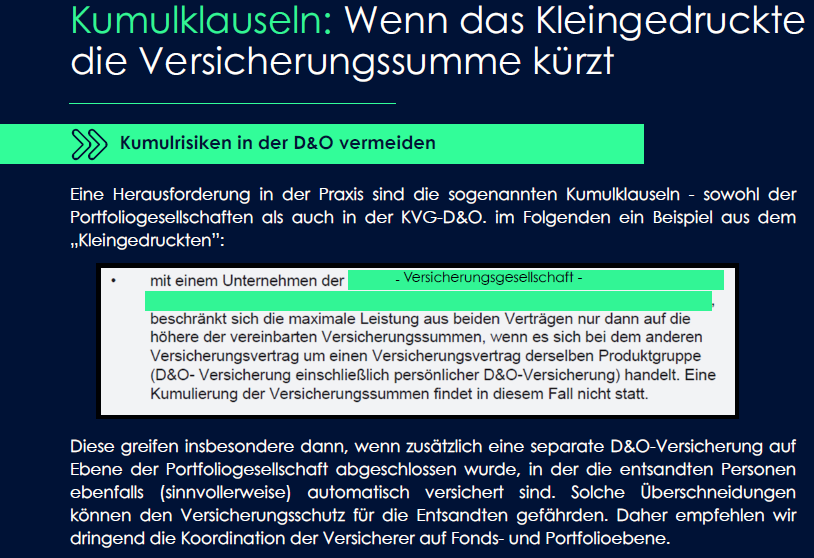

You should also check whether the D&O insurance of the PE/VC and that of the portfolio company are with the same insurer. In this case, it is important to check that there are no hidden accumulation clauses in the small print. In the event of a claim, such clauses, which can be found in almost all insurers' terms and conditions and also in some brokers' terms and conditions, can significantly reduce the amount of insurance cover.

We explain how to deal with this problem in detail in our free Private Equity Insurance Guide 2025.

We let our work and our clients speak for us.

"The high professional quality and customer orientation in the advice and cooperation with Mr. Eckstein and his team ensure that we always feel that we are in good hands with the special requirements as a globally active SDAX company, for example in complex questions of capital market liability. As a listed investment company, Risk Partners' structured and professional support is decisive for us when choosing our broker."

"As a venture capital company, we were very satisfied with the advice provided by Björn and his team. We were impressed by their in-depth understanding of the industry and their innovative strength, which is why we are happy to recommend Risk Partners."

"Risk Partners supports us very reliably with comprehensive expertise, both in the area of the special risks of a venture capital fund and with a sound understanding of the life sciences industry. We greatly appreciate the cooperation with Mr. Eckstein and his team and especially the professional and forward-looking advice, which is optimally tailored to our needs. We can highly recommend the choice of Risk Partners' specialists to other VC funds and life sciences companies."

"As a young company, we spoke to a number of insurance brokers about the insurance issue and in the end we were happy and grateful to have found real VC experts in Risk Partners. While it was difficult elsewhere, Risk Partners understood us straight away, competently explained our industry risks and was able to quickly implement our wishes on the insurance market on the basis of Risk Partners' own concepts. We can therefore only recommend the professionals at Risk Partners."

"We had an excellent experience working with Risk Partners and their team. Their deep expertise in the venture capital sector and exceptional innovation stood out, and we are happy to recommend Risk Partners without hesitation."

"Our collaboration with Risk Partners was consistently positive. We were particularly impressed by their in-depth industry knowledge in the venture capital and life sciences sectors and their innovative strength with their own solutions. We are therefore happy to recommend Risk Partners and feel very well looked after."

Are you responsible for a venture capital fund? Then we have created a separate topic page for you, including a free guide with benchmarks on sums insured & insurance premiums (costs), tips and specific claims.

Choosing the right sum insured is one of the key decisions when taking out D&O insurance. The ideal sum depends on several factors that should be tailored to the individual risk profile of the fund:

Size of the fund: Funds with a higher volume generally require a higher sum insured, as the potential liability risks increase accordingly.

Investment focus: Funds that invest in riskier sectors such as crypto or biotechnology should consider higher hedging. Geographic investment focuses, such as the USA, can also harbor additional risks.

Number and type of LPs: A high number of LPs or the presence of plaintiff-friendly investors (e.g. from the USA) increases the likelihood of liability claims.

Separate limits vs. shared limits: Separate limits for D&O and E&O insurance offer greater flexibility, but are associated with higher premiums.

Sector-specific benchmark data: The Risk Partners benchmark database shows that common insurance sums for VC and PE funds range from €5 million to €25 million, depending on fund size and risk profile.

Premium budget: On average, the premiums for the first million euros sum insured are around 7,000 to 8,500 euros. Additional capacity can usually be added at a lower price.

Comprehensive advice from a specialist insurance broker is essential to determine the optimum sum insured and ensure that all specific risks of the fund are covered.

Personal D&O insurance is a special form of liability insurance that does not cover the company or the fund company (as with traditional corporate D&O), but is tailored individually to the managing persons such as general partners. This protection is particularly relevant if claims are made against board members personally, e.g. by insolvency administrators, supervisory authorities or limited partners (LPs) who are willing to sue.

Differences to the classic corporate D&O:

Focus on the individual: While the corporate D&O provides protection at company level, the personal D&O offers personal cover, independent of the fund company's cover.

Independence: The insurance also applies if the company itself is unable to pay due to insolvency or a lack of corporate D&O cover.

Extended protection: In complex international structures or cross-border liability claims in particular, the personal D&O is an important instrument for protection.

Special features in the PE/VC sector:

In the private equity and venture capital sector, the spread of personal D&O insurance is very limited. This is due to the fact that only around three providers offer this special cover in Europe. This limited availability makes the policies more expensive and means that they are less widespread than in other sectors such as traditional SMEs or large corporations.

Despite the higher costs, the Personal D&O offers considerable advantages for GPs, especially if independent cover is desired to protect their own assets.

Are you responsible for a private equity fund? Then we have created a special topic page for you, including a free guide with benchmarks on sums insured & insurance premiums (costs), tips and specific claims.

D&O insurance for VC and PE funds should be tailored to the specific requirements of this sector. Important aspects include:

Specific insurance conditions: Standard terms and conditions from insurers are often too general. Specialized broker wording that is tailored to the requirements of investment companies prevents open question marks in the event of a claim and opportunities for insurers to refuse benefits.

Separate limits for D&O and E&O: Separate sums insured minimize the risk of claims under one policy affecting the capacity of the other. In terms of premiums, the additional costs should be weighed up against an investment in higher sums insured

Dynamic adjustment: The insurance cover should be reviewed regularly and adjusted to changes in fund structures or legal requirements.

Sufficient sums insured: Depending on the fund volume and risk profile, sums insured should be selected that are sufficient even for complex claims

For general partners of venture capital and private equity funds, D&O insurance is an indispensable instrument for minimizing personal liability and safeguarding their professional activities. The close integration with E&O insurance also offers comprehensive protection against typical risks in this sector. A specialized insurance broker can help to develop individual solutions and ensure optimal protection.

Creativity and

innovations for your portfolio companies too

Experienced D&O experts

Probably the most important insurance for a clinical trial worldwide. Our experts provide a brief introduction.

If patents/IP is the value of your company, you can find out everything you need to know about relevant insurance policies here

Alongside D&O insurance, this is probably the most important insurance for a European IPO. Our experts provide a brief introduction.

Another important insurance for volunteers in clinical trials. Our experts briefly introduce these.

Request our guides now